san francisco sales tax rate breakdown

8617 California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent.

Understanding California S Sales Tax

The current total local sales tax rate in South.

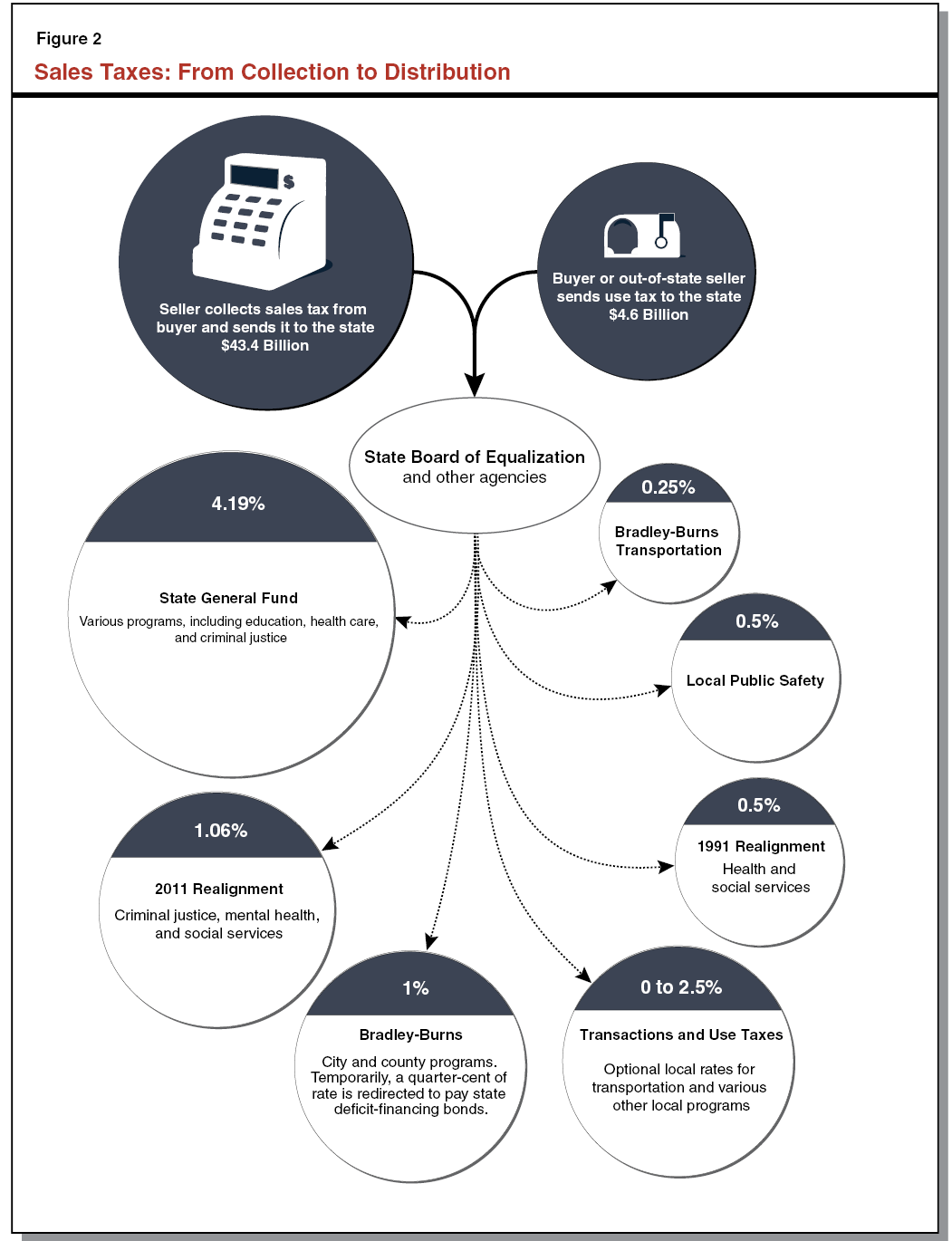

. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The statewide tax rate is 725. District tax areas consist of both counties and cities.

You can print a 9625 sales tax table here. Where can my clients smoke. Sales tax is 85 percent.

The tax is collected by hotel operators and short-term rental hostssites and remitted to the City. Fast Easy Tax Solutions. Sales Tax Revenue Base FY02-03 Actuals.

California has recent rate changes Thu Jul 01 2021. The sales tax amounts in the interactive map above represent only the collections attributable to local Bradley-Burns portion of sales tax from 2011 to 2016. The Golden State fares slightly better where real estate is concerned though.

4 rows The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. Those district tax rates range from 010 to 100. The December 2020 total local sales tax rate was 9250.

File Monthly Transient Occupancy Tax Return. 4 rows Sales Tax Breakdown. The 9875 sales tax rate in South San Francisco consists of 6 California state sales.

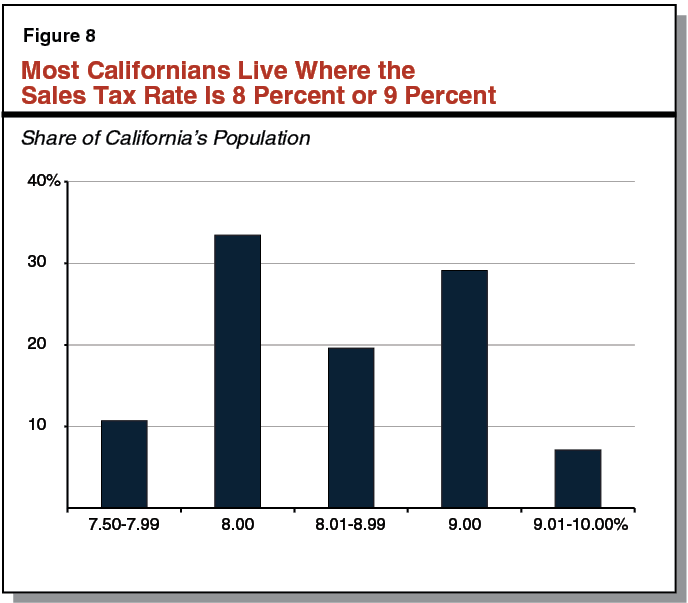

This page will be updated monthly as new sales tax rates are released. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country. There may also be more than one district tax in effect in a specific location.

Click here for a larger sales tax map or here for a sales tax table. The transient occupancy tax is also known as the hotel tax. 3 rows Sales Tax Breakdown.

San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. Hotel fees in San Francisco include 14 percent occupancy tax and 115 percent Tourism Improvement District assessment depending on the location of the property. Presidio San Francisco 8625.

What is the sales tax rate. For a full historical description of sales tax rates and beneficiaries in San Francisco and. Over the past year there have been 58 local sales tax rate changes in California.

South San Francisco CA Sales Tax Rate. The last time the Board of Supervisors adjusted local sales taxes was in 1993. Presidio of Monterey Monterey 9250.

Smoking is permitted only in. Select the California city from the list of cities starting with A below to see its current sales tax rate. Some areas may have more than one district tax in effect.

The San Francisco County California sales tax is 850 consisting of 600 California state. The 9625 sales tax rate in San Mateo consists of 6 California state sales tax 025 San Mateo County sales tax 025 San Mateo tax and 3125 Special tax. By state law local governments can enact up to 200 in local sales taxes.

Sales Tax Rate plus applicable district taxes Prepayment of Sales Tax Rate per gallon Excise Tax Rate per gallon 072021062022. For tax rates in other cities see California sales taxes by city and county. A base sales and use tax rate of 725 percent is applied statewide.

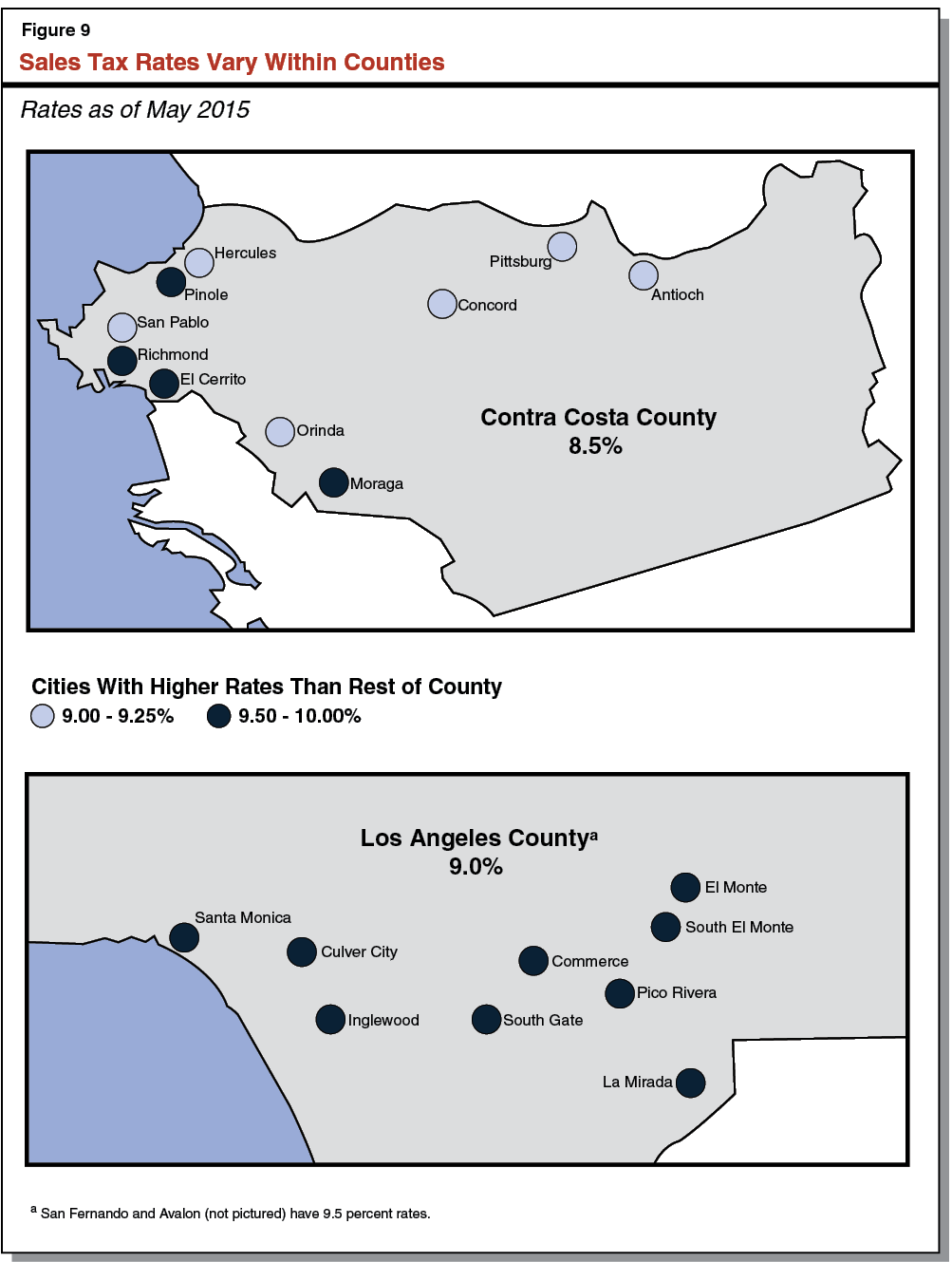

6 Average Sales Tax With Local. With local taxes the total sales tax rate is between 7250 and 10750. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes.

Ad Find Out Sales Tax Rates For Free. San Francisco County 940 JPBT 8500 8625 San Mateo County This rate applies in all unincorporated areas and in incorporated cities that do not impose a district tax 942 JPBT 9250 9375 City of Belmont 943 9750 9875 City of Burlingame 944 9500 9625 City of Daly City 945 9750 9875 City of East Palo Alto 946 9750 9875. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

San Francisco suffered the worst drop in sales taxes in California this year even after businesses began reopening and may have also suffered a drop in. The average homeowner pays just 073 of their actual home value in real estate taxes each year. There are a total of 475 local tax jurisdictions across the state collecting an average local tax of 2617.

California CA Sales Tax Rates by City A The state sales tax rate in California is 7250.

Us Sales Tax On Orders Brightpearl Help Center

California Sales Tax Guide And Calculator 2022 Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Food And Sales Tax 2020 In California Heather

California Sales Tax Rates By City County 2022

Frequently Asked Questions City Of Redwood City

California Sales Use Tax Guide Avalara

How Do State And Local Sales Taxes Work Tax Policy Center

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Understanding California S Sales Tax

California Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Collections City Performance Scorecards

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Understanding California S Sales Tax

Understanding California S Sales Tax

California City County Sales Use Tax Rates

Understanding California S Sales Tax

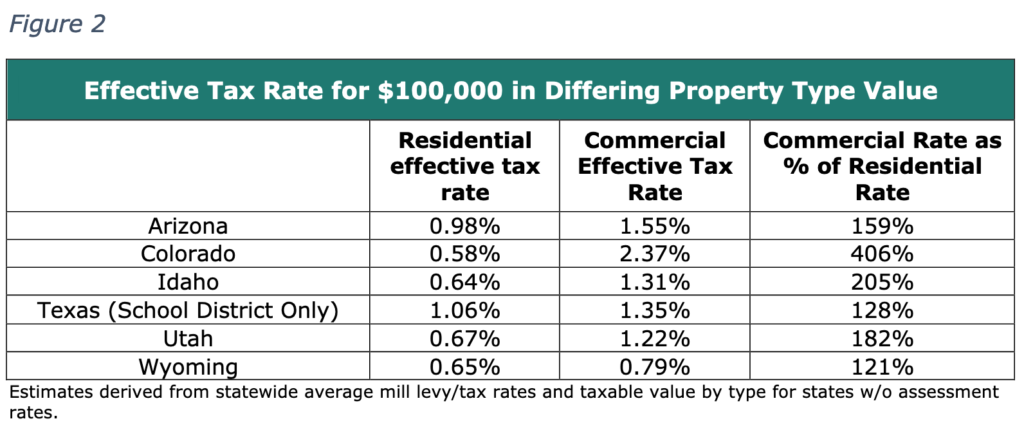

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute